Automatic Exchange of Information (AEOI): New Registration Requirement for Trusts

Katriona McEwan · Posted on: December 23rd 2025 · read

Further to the enactment of The International Tax Compliance (Amendment) Regulations 2025, certain trusts are now required to complete a one-off registration with HM Revenue & Customs (HMRC) for Automatic Exchange of Information (AEOI).

This sits alongside, and does not replace, the existing Trust Registration Service.

This requirement applies to all trusts that are deemed as a Financial Institution, and the registration must be completed by 31 December 2025.

When is a trust treated as a Financial Institution?

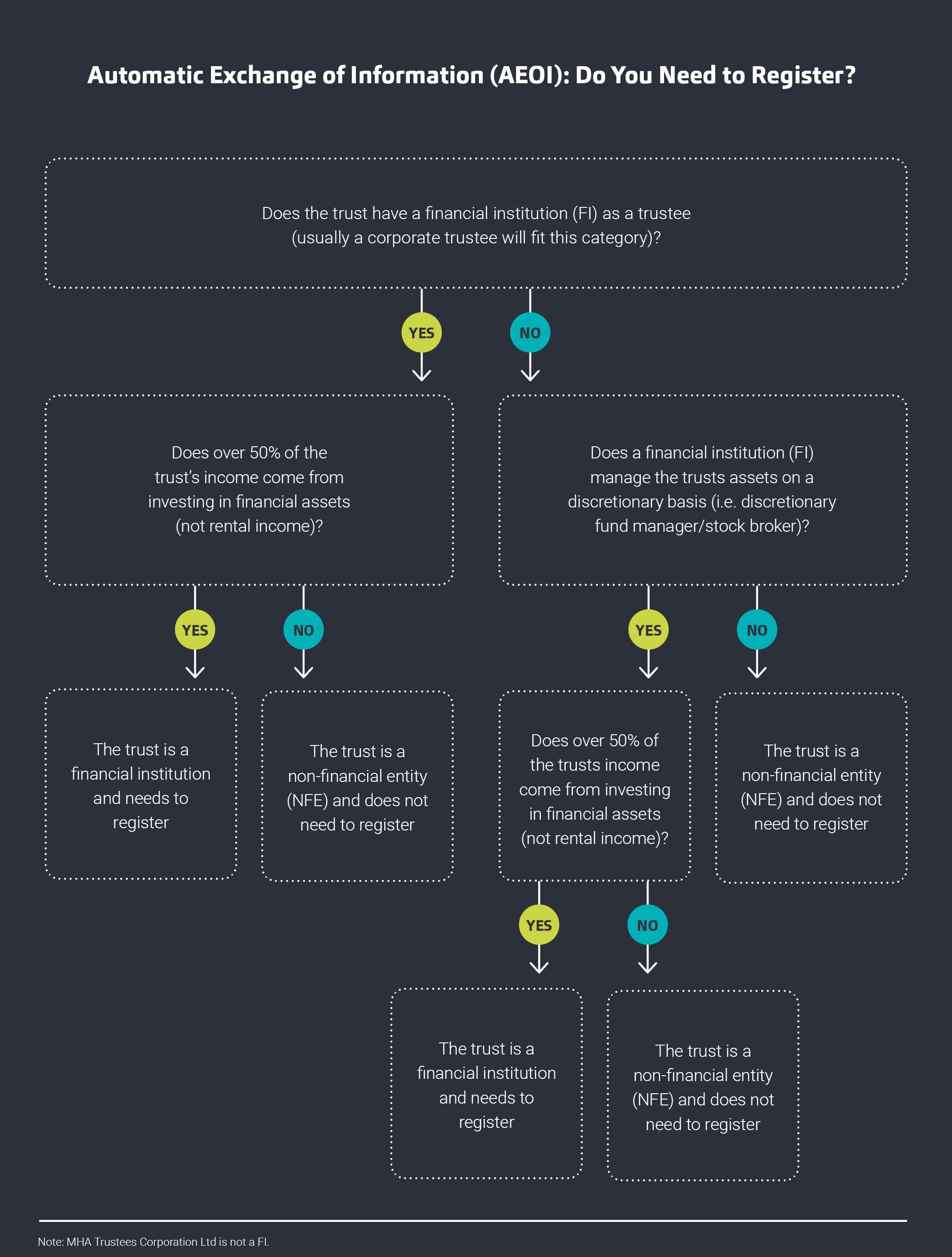

A trust will be classified as a Financial Institution for AEOI purposes where both of the following conditions are met:

The trust is managed by another Financial Institution, for example:

its trustee is a professional entity (financial institution) which manages the trust in the course of its business, for example a corporate trustee; or

its assets are managed by an investment manager (such as a stockbroker) under a discretionary mandate.

The trust derives at least 50% of its income in a specified period from investing, reinvesting or trading in Financial Assets.

Trustees should review whether the trust meets the Financial Institution criteria outlined above.

What are the penalties for failing to register?

Failure to register by 31 December 2025 can result in an initial penalty of £1,000.

However, we understand that due to the limited general awareness of this change, HMRC are unlikely to apply penalties where trustees have made reasonable efforts to comply with the registration requirement by the deadline.

How do trustees register?

Before beginning the registration process, trustees should ensure they have the following information available:

The trust’s name (as given when registering the trust on the Trust Registration Service (TRS) or included on the trust’s tax return)

The trust’s Global Intermediary Identification Number (GIIN), if held

The trust’s Unique Tax Reference (UTR)

Registration must be completed via the Trust’s Government Gateway logon. Trustees can access the AEOI registration service through the Register for Automatic Exchange of Information GOV.UK page, selecting “Register now” and following the on-screen instructions.

If the Trust’s Government Gateway login has not been used for a number of years, HMRC may have deleted this and a new login will need to be created.

Please note that the route to registration may differ depending on the type of trust. HMRC’s systems and guidance may also change, and trustees should ensure they follow the most up-to-date instructions available on GOV.UK.

If you need any support with registering, or think you will be unable to meet the deadline, please email [email protected].

How can MHA help?

Although HMRC does not currently allow agent access to the AEOI registration platform (meaning we cannot complete the registration on behalf of trustees), we can support trustees by:

Analysing the trust to confirm whether it is required to register

Advising on whether the trust meets the Financial Institution criteria

Collating the information required for registration

Supporting trustees through the registration process

Our support is tailored to the complexity of each trust, and we are happy to discuss the appropriate level of assistance required. Please speak to your usual MHA adviser or contact us today.