Employee Ownership Day – Celebrating a model that puts people at the heart of business success

Steven Tebbutt · Posted on: June 20th 2025 · read

Employee Ownership Day is a great opportunity to highlight the real-world benefits of employee ownership - for businesses, employees, and communities. As interest in this model continues to grow, it’s clear that giving employees a genuine stake in the company’s future helps create a more committed, collaborative, and resilient workforce.

At MHA, we’ve helped many business owners explore and implement employee ownership as a succession route. For those who care about what happens to their business after they step back, employee ownership can be a powerful way to preserve culture, reward employees, and keep the business independent. The tax benefits include an effective Capital Gains Tax (CGT) free sale for the vendor and the ability to pay tax free bonuses to employees.

A growing movement – and a more robust framework

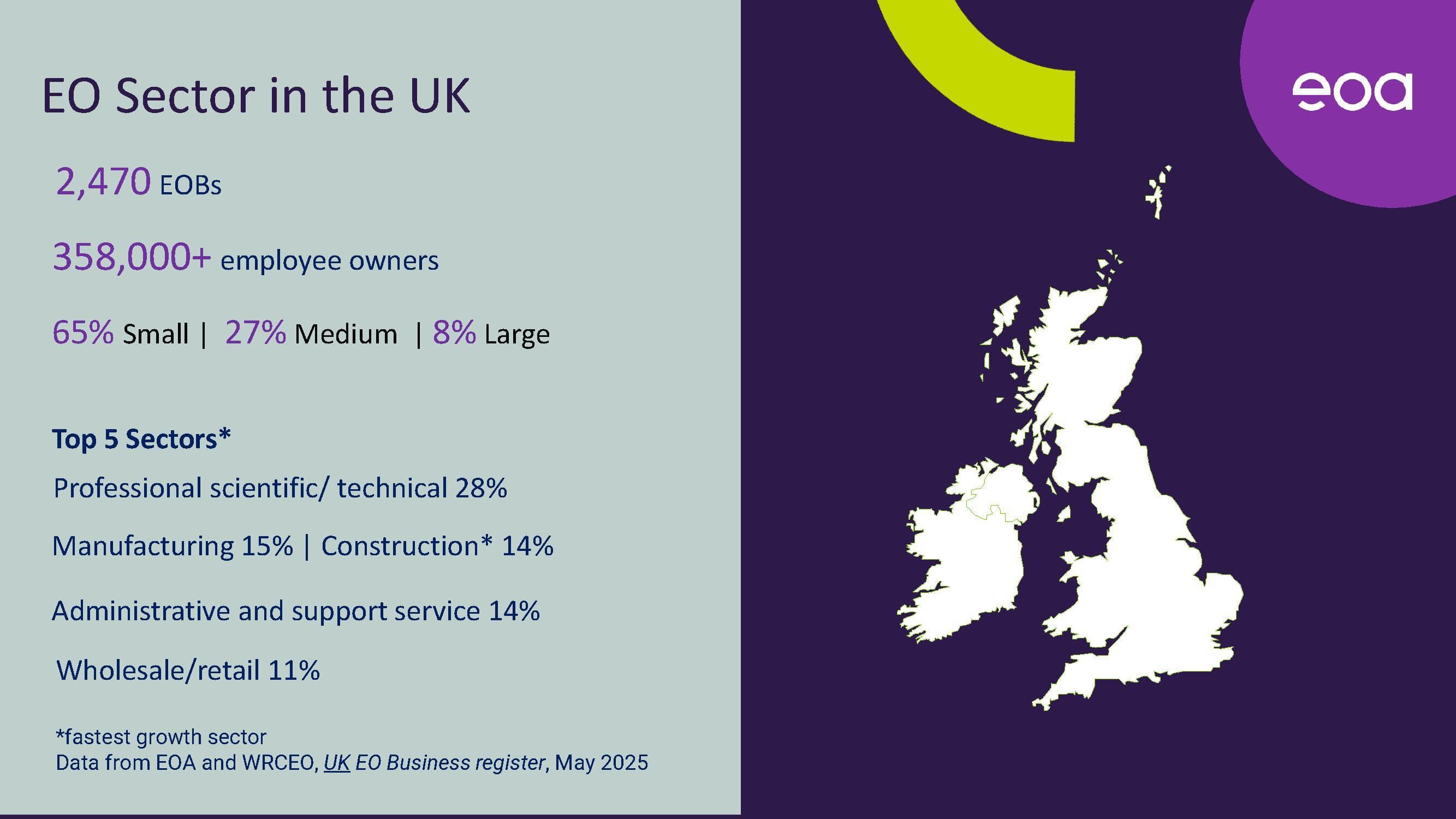

There are now more than 2,500 employee-owned businesses in the UK, and the growth in the past few years has been particularly striking.

From professional services firms to manufacturers and retailers, more and more businesses are seeing employee ownership as a practical and meaningful alternative to trade sales or private equity.

The most popular way to transition a trading company to employee ownership is for the owners to sell their shares to an Employee Ownership Trust (EOT) for an effective 0% CGT rate.

The October 2024 Budget introduced a number of changes to the rules governing sales to EOTs. These changes are aimed at strengthening the integrity of the model and ensuring that the tax reliefs continue to support genuine employee-owned businesses. Key reforms include tighter rules on how businesses are valued and clearer requirements around independence and governance. These measures are welcome. They add clarity, provide reassurance to selling shareholders, and help ensure that employee ownership continues to be seen as a credible and robust option for succession planning.

Another area that’s attracting attention is the growing use of blended ownership models. These combine the inclusive structure of an EOT with more targeted equity incentive arrangements for key individuals — typically through share options or growth shares. For many businesses, this strikes a good balance: employees as a whole benefit from indirect ownership via the trust, while senior leaders or high performers can also be rewarded more directly for driving the business forward. It’s an approach we’re increasingly discussing with clients, especially those looking to attract or retain talent post-transition.

Why employee ownership?

For employees, ownership brings a stronger sense of purpose and involvement in the business. It can lead to better engagement, lower staff turnover, and stronger financial performance over time. For owners, it offers a chance to step away from the business in a way that feels aligned with their values and protects the legacy they’ve built.

While the tax advantages of an EOT — including a potential 0% CGT on a qualifying sale — are becoming better known, most of the business owners we speak to are just as motivated by what employee ownership means for their people and their company’s future.

Who is it for?

"We’re seeing growing interest across a wide range of sectors. Knowledge-based businesses — like consultancies, architects, and agencies — remain strong candidates, but we’re also seeing successful transitions to employee ownership in the healthcare, manufacturing, and construction sectors."

Employee ownership works particularly well for “people” businesses that value long-term thinking, strong employee engagement, and a sense of shared purpose. If culture matters to you, and you’re looking for a succession plan that reflects that, employee ownership is well worth considering.

Whilst the reliefs are designed around businesses within a company or group, we are also seeing sole traders and partnerships incorporating ahead of a sale to an EOT.

How MHA can help

At MHA, we support business owners at every stage of their journey towards employee ownership - from early-stage feasibility discussions through to implementation - and beyond.

Whether you’re looking at an EOT, have an EOT already, or just want to understand your options, we’ll help you find the right solution for your business and your team.

To find out more, speak to Steve Tebbutt, Chris Blundell, or Hasan Hashmi.

Contact the teamView our latest insights

The hidden VAT trap in post-Brexit imports: Why non-ownership of goods could cost your business thousands

Andrew Thurston

Customs Duty & Indirect Tax Consultant

Andrew Thurston

Customs Duty & Indirect Tax Consultant

Tax and ESG Roundtable: From Compliance to Strategic Value

David Stone

Tax Director

David Stone

Tax Director

UK business deals in 2025: Signs of a comeback despite global challenges

Rob Dando

Corporate Finance Partner and Transaction Services Leader

Rob Dando

Corporate Finance Partner and Transaction Services Leader